Understanding Binary Options

Binary options trading involves predicting the direction of an asset’s price movement within a predetermined timeframe. Essentially, traders speculate whether an asset’s price will rise or fall, and if their prediction proves correct, they receive a predetermined, fixed payout. Conversely, if the prediction is incorrect, the trader faces a loss, usually amounting to the entire investment in the option. Binary options, by their nature, have only two possible outcomes, which makes them quite straightforward: they end “in-the-money” (profitable) or “out-of-the-money” (unprofitable). The simplicity and clarity of potential outcomes play a role in their attractiveness to both beginner and experienced traders.

The critical aspect of trading binary options is the specific condition set regarding the asset’s price. For example, a trader might predict that the price of a stock will be above a certain level at the end of a given timeframe. If the stock indeed finishes above that level, the trade is successful. This investment form is accessible, offering a variety of underlying assets ranging from forex and commodities to indices and stocks, enabling diverse strategies and approaches.

Trend Reversals in Trading

A trend reversal in a market signifies a change in the prevailing direction of price movement, often marking the transition from an upward trend to a downward one or vice versa. Identifying and accurately predicting these reversals can be crucial for making informed trading decisions as they provide valuable opportunities to optimize entry and exit points for trades. Successfully recognizing a trend reversal can mean buying near a low before an uptrend or selling near a high before a downtrend sets in.

Identifying Trend Reversals

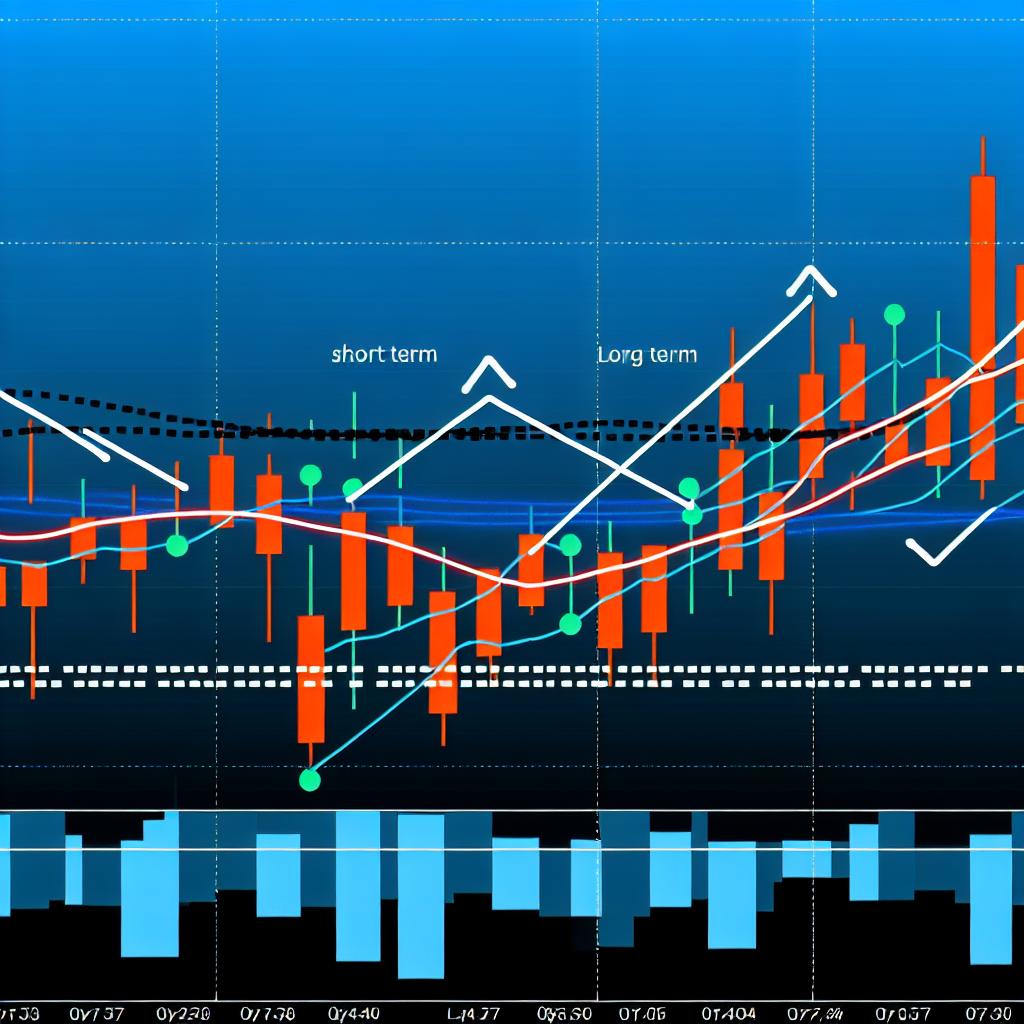

The process of identifying trend reversals often involves a combination of technical analysis tools and indicators. Indicators such as Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) are commonly employed to assist in these predictions. The RSI measures the speed and change of price movements and can indicate overbought or oversold market conditions, often a precursor to reversals. On the other hand, the MACD reveals changes in the strength, direction, momentum, and duration of a trend in an asset’s price, thus helping traders anticipate a reversal.

While these indicators provide valuable insights, they are typically most effective when used in conjunction with other techniques, such as chart patterns and the analysis of trading volumes. Complementary tools can provide a more comprehensive picture, empowering traders to make informed decisions with greater accuracy.

The Role of Support and Resistance

Support and resistance levels are foundational concepts in binary options trading. Support is defined as a price level where a downtrend can be expected to pause due to a concentration of demand or buying interest. Conversely, resistance levels are where an uptrend is anticipated to pause, resulting from a concentration of supply or selling interest. Identifying these levels is a crucial skill, as they are often indicative of potential trend reversals.

When an asset’s price approaches these critical levels, it faces pressure that might prompt a reversal. This possibility provides opportunities for entering or exiting trades based on anticipated reactions. Traders using binary options can capitalize on these movements by predicting breaks or bounces off these levels, thereby potentially capturing favorable entries or exits.

Strategies for Trading Trend Reversals

In trading binary options, strategies that effectively anticipate and capitalize on trend reversals are vital. Successful strategies are often multifaceted, combining various forms of analysis such as technical indicators, chart patterns, economic news, and fundamental data.

Using Candlestick Patterns

Candlestick chart patterns are invaluable in identifying potential reversals. They graphically represent trading activity during a specified timeframe and can signal impending reversal points. Notable patterns include engulfing patterns and hammers. An engulfing pattern occurs when a small candle is followed by a larger candle that completely “engulfs” it, signaling a potential reversal. A hammer, occurring after a downward trend, signifies a potential bottom and reversal upwards.

Within the broader trend context, patterns like the double tops and double bottoms are also crucial. Double tops can indicate the end of an uptrend and a potential downward reversal, while double bottoms can suggest the end of a downtrend with an upward reversal likely.

Integrating Market Analysis

Beyond technical analysis, the integration of market analysis is essential for successful binary options trading around trend reversals. Market news and economic indicators can provoke significant price movements and trend reversals. Traders need to remain informed about events such as central bank announcements, employment reports, or geopolitical developments that could influence market sentiment and price actions.

Incorporating these insights into your trading strategies provides a comprehensive approach to anticipating market shifts. Understanding the potential impacts of external factors on asset prices allows traders to set their positions in anticipation of potential volatility and market movements.

Risk Management

Implementing effective risk management techniques is crucial when trading binary options to safeguard investments. Key strategies include setting predefined entry and exit points to delineate clear parameters under which trades are executed. Additionally, adopting stop-loss orders can protect investments by automatically closing positions that veer into loss territory beyond comfort levels.

Maintaining a balanced approach in position sizing relative to one’s account size is also essential. Traders should be cautious of overleveraging, which can lead to significant losses and capitalize on high-risk scenarios disproportionate to their financial position and risk tolerance.

It is just as crucial to stay educated and continuously refine strategies. Engaging with educational resources, attending webinars, and tracking real-time market data are all part of a robust trading protocol. Comprehensive understanding aids traders in refining their approaches and improving their ability to anticipate and profit from trend reversals in binary options trading. For instance, financial sites like Investopedia offer extensive resources on technical analysis and trading strategies.

By leveraging these techniques and continuously adapting to market dynamics, traders can enhance their opportunity to benefit from the binary options market while effectively managing risk.